Scroll #7: MetaDAO Vs Token Launchpads

A Comparison of Launchpads Available to Solana Founders

Blockchain and everything on it today is an experiment.

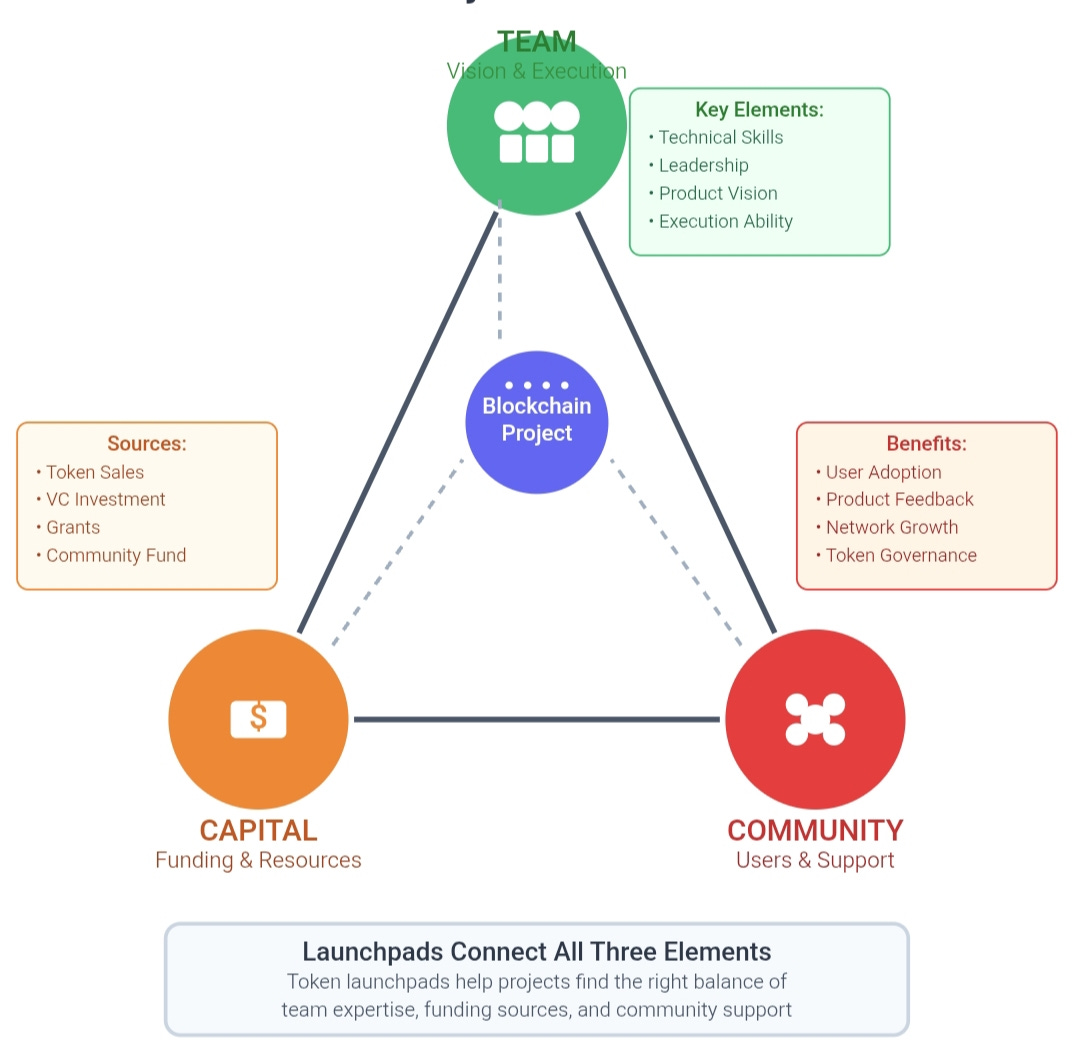

However, some experiments are more successful than others. What makes this possible is a mixture of team, community, and capital.

Now you're probably asking why we're using these terms; let's go back to Silicon Valley, USA. Software engineers come up with ideas involving the next social platform, fintech, or AI tool. They build in the open and attract communities, but they can only push forward with capital investment from Venture Capitalists (VCs).

This financial barrier exists because software is a high-risk sector. However, we've seen how viral successful software products can be, but not every idea gets the capital needed to push forward and attain profitability. The thing is, traditional VCs are picky, and they mostly prefer established crypto startups.

How do promising blockchain startups or initiatives get early-stage funding to carry out their experiments? They need a mix of community and investors who can believe in the projects. With tokens and blockchain launchpads, they have a community of investors who want to support and invest in the initiatives long-term.

So in this article, we discuss and compare how startup teams and founders can raise money for their various initiatives through token launchpads, highlighting top launchpads like DAO Maker, Fjord Foundry, Believe App, and MetaDAO, and providing guides and steps to picking the launchpad that serves them best.

The History of Blockchain Fund Raising: Retelling the Shift from ICOs to Launchpads

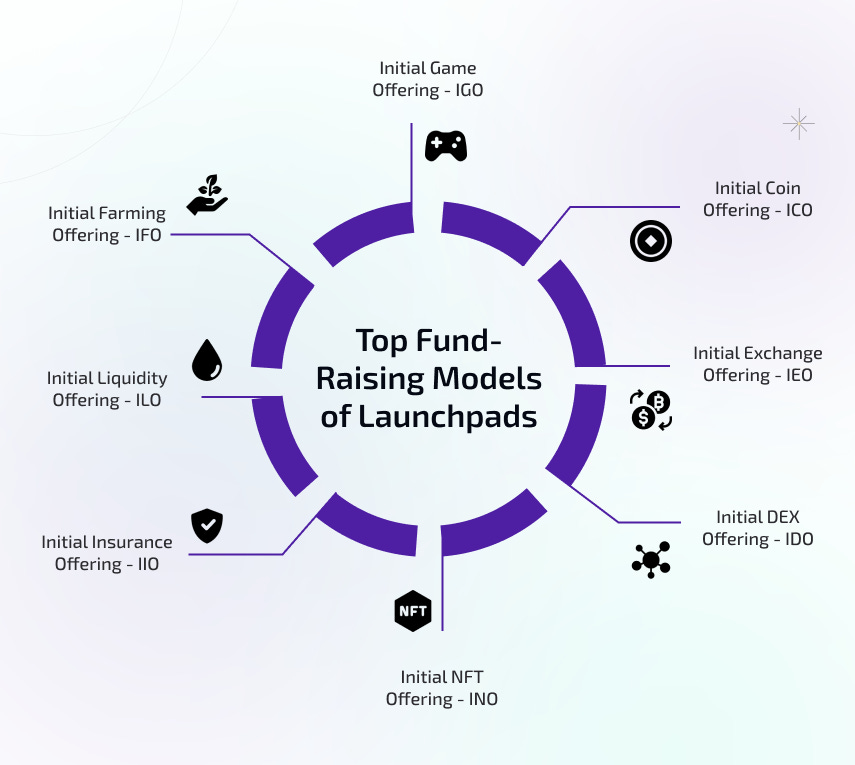

Launchpads are platforms used for carrying out structured sales of cryptocurrency tokens to interested community members and investors of a particular project. They allow community and retail to invest and share in the growth and future network effects of a project, initiative, or protocol.

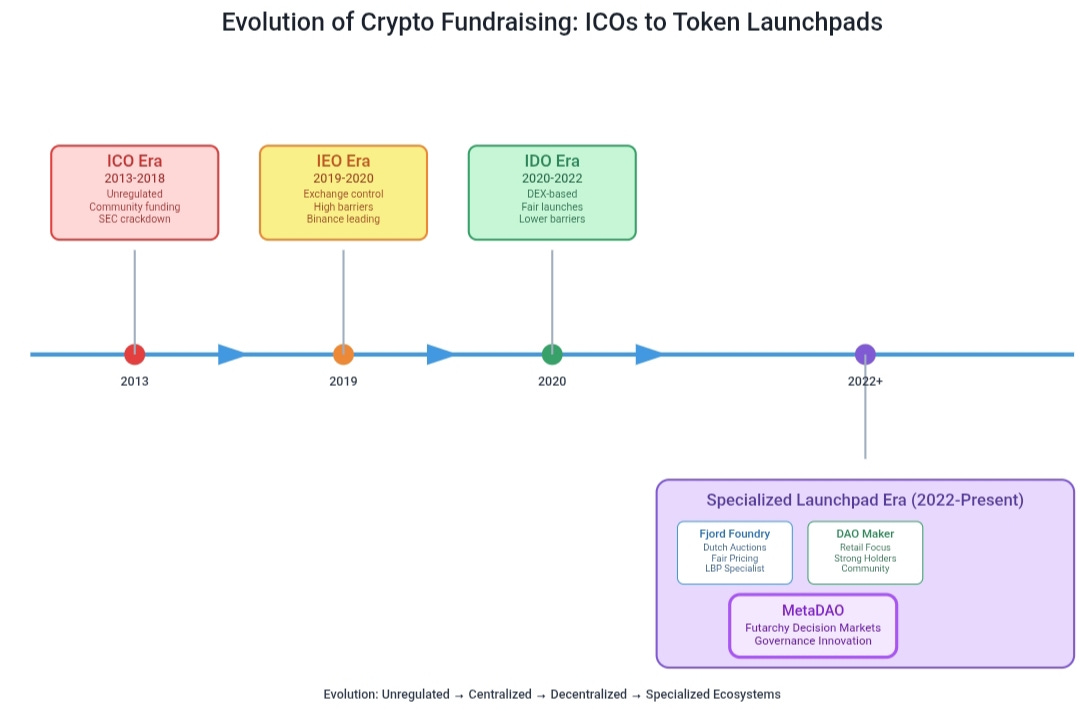

While launchpads became prominent in 2019 through centralized exchanges and their Initial Exchange Offerings (IEOs), community fundraising or capital investment had already existed in the form of Initial Coin Offerings (ICOs) since 2013.

The ICO boom of 2017-2018 allowed blockchain teams to raise community funding for their experiments in exchange for native tokens. However, US SEC scrutiny in 2019 led to securities litigation, shifting the landscape toward traditional VC funding that required startups to reach advanced development stages before pitching. While IEOs on exchanges like Binance emerged as an alternative, their high barriers to entry only favored fully operational startups, leaving early-stage projects with limited funding options.

Initial DEX Offerings (IDOs) emerged as an alternative, allowing founders to raise funds through DEX launchpads via fair launches or structured presales based on investor capabilities. As most DEXs couldn't support these systems, specialized platforms like Believe App for social token funding, Fjord Foundry for permissionless fundraising, and MetaDAO for community-aligned projects evolved into today's token launchpads. This swift evolution from ICOs to decentralized launchpads highlights blockchain's rapid technological and economic advancement.

Launchpads Today: Comparing the Top Three Launchpads

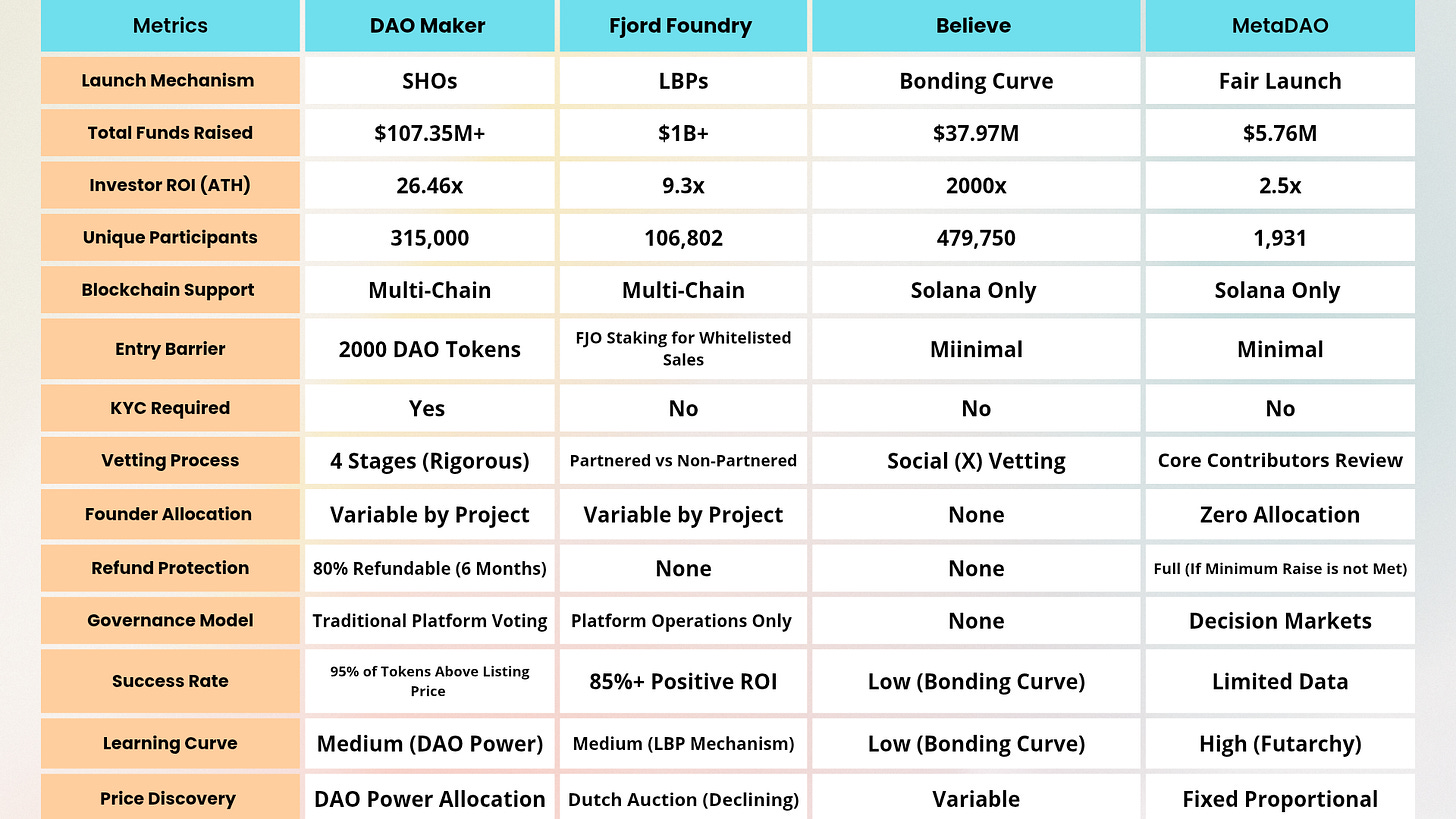

Since we have established the evolution and purpose of launchpads, we will now take a deep dive into 3 different platforms chosen for their wide adoption (including Solana). We compared their launch and raise metrics, their unique token offering mechanisms, and the particular types of founders and investor communities they service.

We are comparing Fjord Foundry, DAO Maker, Believe App, and MetaDAO to help founders and teams understand which launchpad suits their token launch or fundraise in the long term in terms of holder behavior, verification and regulatory processes, and overall operations.

Fjord Foundry: The Dutch Auction Launchpad

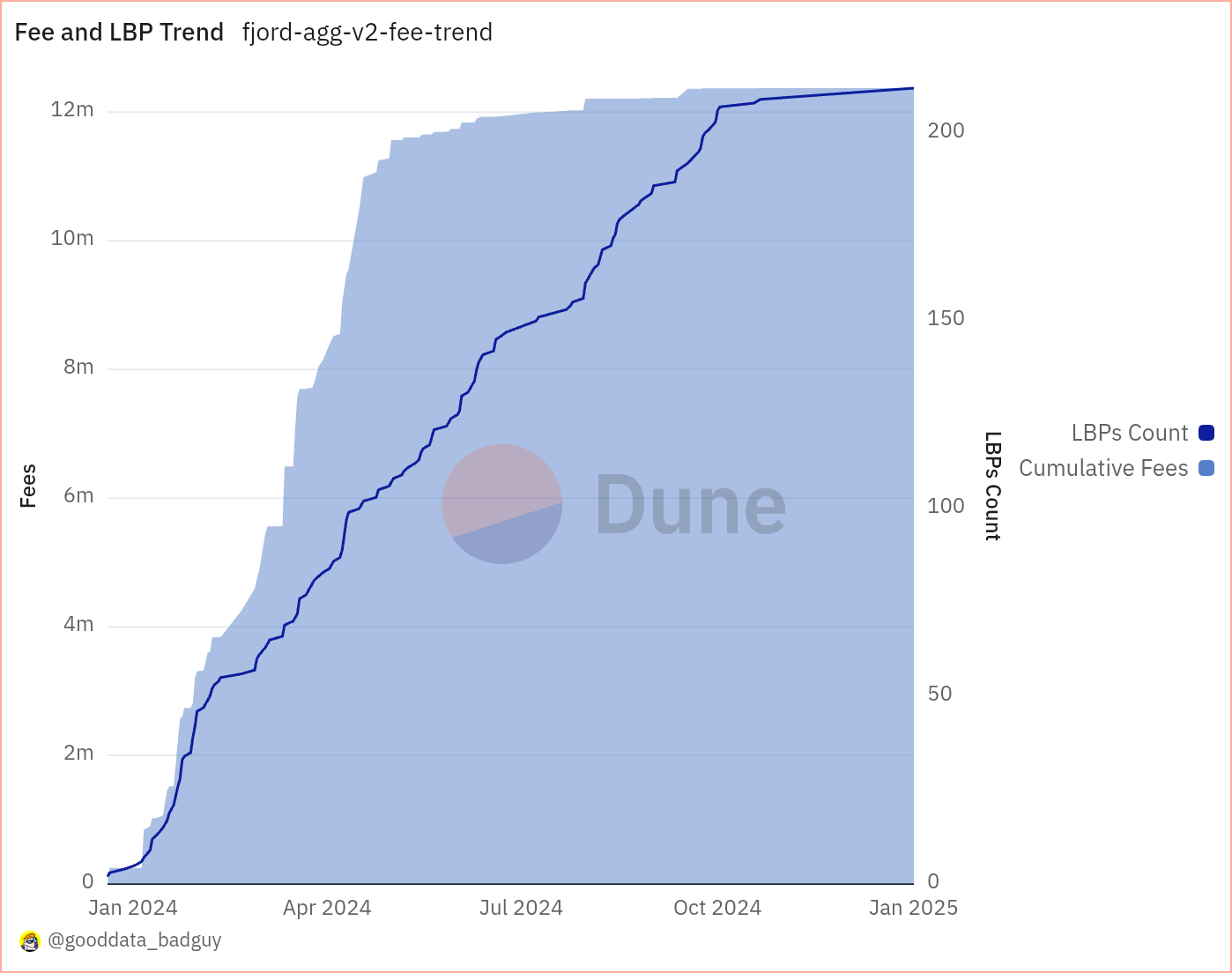

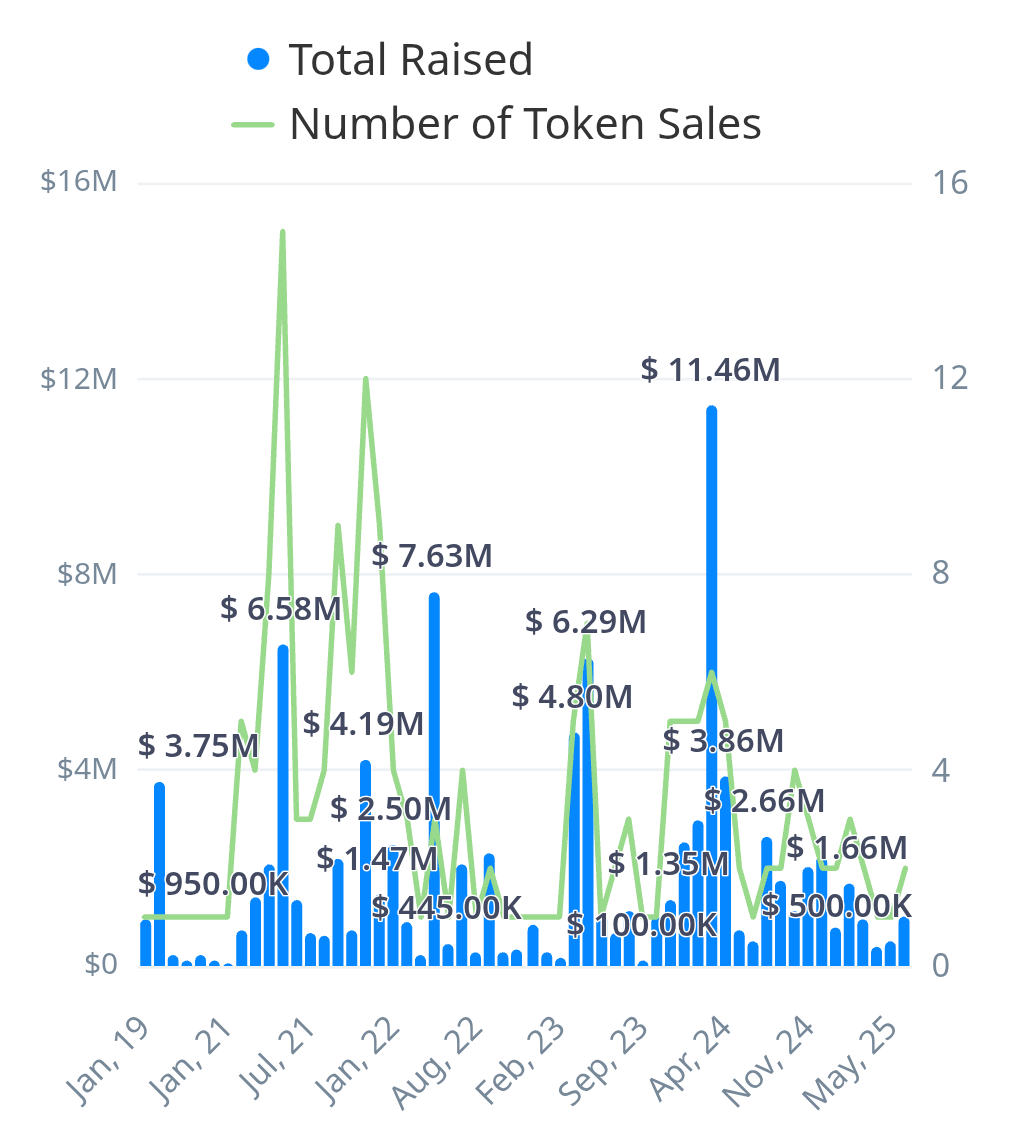

Fjord Foundry is one of the most prominent launchpads in the blockchain ecosystem today, having been home to numerous successful fundraisers since its 2021 launch.

Stabble (a Solana DeFi Liquidity Protocol) raised $400,000 via an IDO on Fjord May 2025.

Platform Metrics

Launch Blockchain: Multi-chain

Total Raised: $1B+

Total Fees Collected: $30M+

Total Fundraisers: 717

Types of Projects: DeFi, AI, GameFi, and blockchain infrastructure

Average Funds Raised: $5M

Unique Participants: 106,802

Investor ROI (ATH): 9.3x

Launch Mechanism

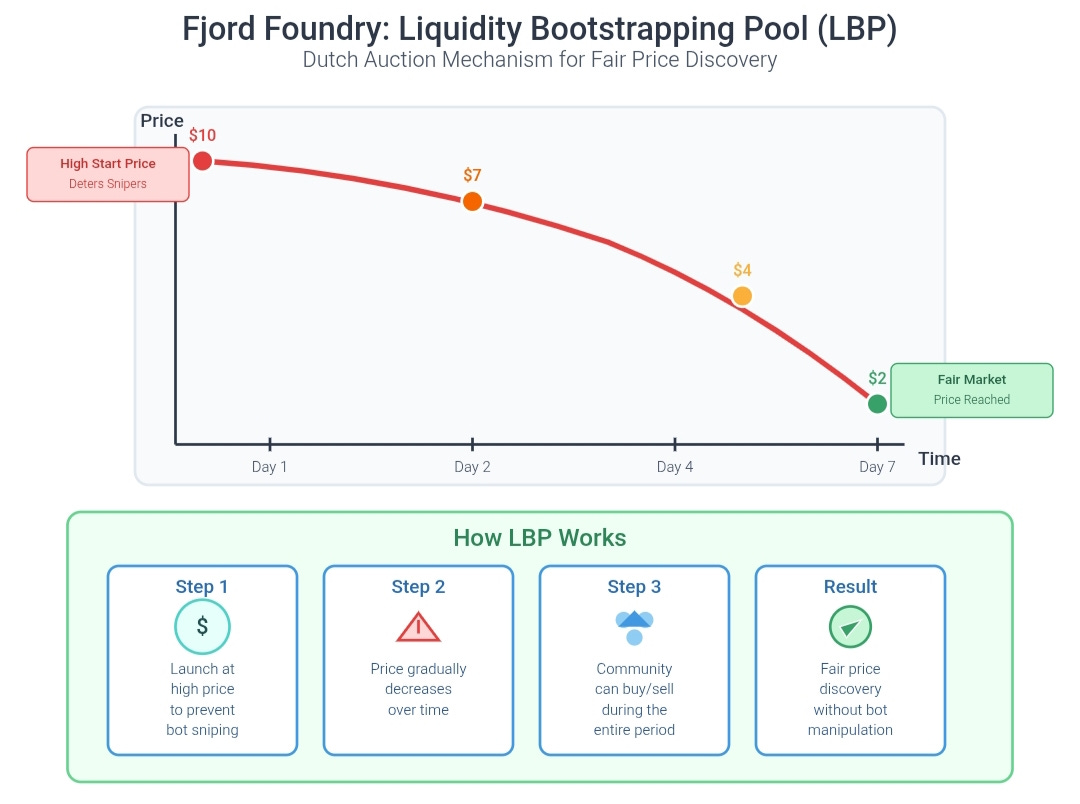

Fjord Foundry is well known for its Dutch auction style of launchpads called Liquidity Bootstrapping Pools (LBPs), which involves the platform listing IDO prices at very high levels to prevent snipers from claiming all spots and whales from manipulating prices during sales.

The price gradually reduces over time to meet available demand, and users can buy and sell their positions in the pool during the IDO period.

It has two other tools—although not frequently used, they are still worth mentioning, one involves a fixed price per token throughout sales (fixed sales) and the other is in rounds with each round have a higher token price than the one before it (tiered sales).

Token Distribution Strategies

Fjord Foundry offers several tools to founders, including:

Token Vesting: Founders can lock and distribute IDO tokens over a period using their preferred vesting schedule.

DEX Listing: Fjord enables founders to automatically lock trading liquidity and list IDO tokens on DEXs.

Placeholder Tokens: Founders can launch an IDO with tokens that will be used to claim actual project or platform tokens on another date.

Token and Token Holder Benefits

Fjord's platform token is FJO, which grants benefits to holders on Fjord Foundry.

Staking: Users stake FJO to earn either FJO or FJOINTS (an inflationary token that is burnt to claim airdrop allocations during FJO staker airdrops) weekly.

FJO staking rewards come from a half of 90% of Fjord Foundry fees.

Whitelisting: Some IDOs on Fjord are whitelisted to only FJO stakers.

Governance: FJO token holders vote on decisions affecting platform operations.

Legal and Technical Mechanisms

Legal and Security: Fjord Foundry has two types of fundraisers; Partnered and Non-partnered. Partnered sales are backed by Fjord and its network of influencers and KOLs, but this occurs after conducting due diligence on the team and allowing an independent audit and security firm to vet them.

Non-partnered sales are not backed by the platform, meaning users launch these IDOs directly.

KYC: No KYC is required for users to participate as it is an open platform but some whitelisted and partnered sales requires them.

User Experience: The platform requires no coding to either participate in or create an IDO, as it has excellent UX that makes everything intuitive.

Ease of Investment: Except during whitelisted sales, anyone can participate in any IDO on Fjord Foundry.

Fjord Foundry Pros

For Founders

LBPs ensure fair pricing and equitable token distribution during sales

Supports both permissionless (open-source) and endorsed sales (secure)

Founders require no coding to set up token sales

Tokens can be instantly listed on DEXs for trading post-launch

For Investors

Fjord's vetting ensures quality projects are listed, providing substantial ROI (2-10x)

LBPs provide fair pricing and drastically reduce bot sniping and whale dominance

FJO stakers earn FJO weekly and can cash out FJOINTS for airdrops

Fjord has a robust system that locks liquidity post-LBPs, ensuring token security.

Fjord Foundry Cons

For Founders

Founders opting for partnered sales undergo rigorous vetting processes that may delay launch time

Platform governance doesn't involve project selection

Token sales without KYC expose projects and teams to regulatory uncertainty risks

LBPs' Dutch auction system may lead to token dumping when project expectations aren't met due to tokens’ high cost.

For Investors

Permissionless sales involve lower-quality projects, increasing loss risks

Non-KYC sales may expose investors to regulatory scrutiny in jurisdictions with strict crypto laws

Understanding LBP mechanics (high-to-low pricing) requires a learning curve, potentially deterring new investors

It's worth knowing that these projects raising are separate entities from the communities of holders created via the IDO, hence they have little or no say on how the raised funds is managed.

Builder Sustainability for Founders

Capital Formation: Fjord's LBPs enable rapid fundraising, with examples like Rage Trade ($6M in 15 minutes) showcasing efficiency

Community Retention: Marketing support and community engagement foster long-term backer loyalty, critical for project growth

Ecosystem Support: Multi-chain compatibility and DEX liquidity ensure founders can scale across ecosystems

Long-Term Viability: Fjord's focus on transparency and fairness supports sustainable projects

Ideal Founders: DeFi, GameFi, or infrastructure teams with audited contracts and moderate campaign budgets ($5K-$20K)

Builder Sustainability for Investors

Return Potential: Fjord's curated projects offer 2-10x ROI.

Community Value: Staking and airdrops provide passive income, enhancing long-term engagement

Information Access: Community AMAs and social media updates keep investors informed, supporting informed decisions

Risk Management: Vetting and liquidity locks reduce scam risks, especially in permissionless sales. KYC sales offer safer bets

Ecosystem Growth: Multi-chain support exposes investors to diverse ecosystems (Solana, Ethereum)

Ideal Investors: Retail and institutional investors comfortable with LBP mechanics, seeking early-stage DeFi/GameFi exposure ($100-$5,000)

DAO Maker: Retail Community Launchpad

DAO Maker is a well-known platform that creates growth technologies and funding frameworks for startups while simultaneously reducing risks for investors.

In March 2024, YOUR AI (a Solana-based AI Content Layer e-commerce platform) raised $150,000 via an IDO on DAO Maker.

Platform Metrics

Launch Blockchain: Multi-chain

Total Raised: $107.35M

Total Fees Collected: $5.37M+

Total Fundraisers: 179

Types of Projects: DeFi, AI, GameFi, and blockchain infrastructure

Average Funds Raised: $600K

Unique Participants: 315,000+ KYC'd users

Investor ROI (ATH): 26.46x

Launch Mechanism

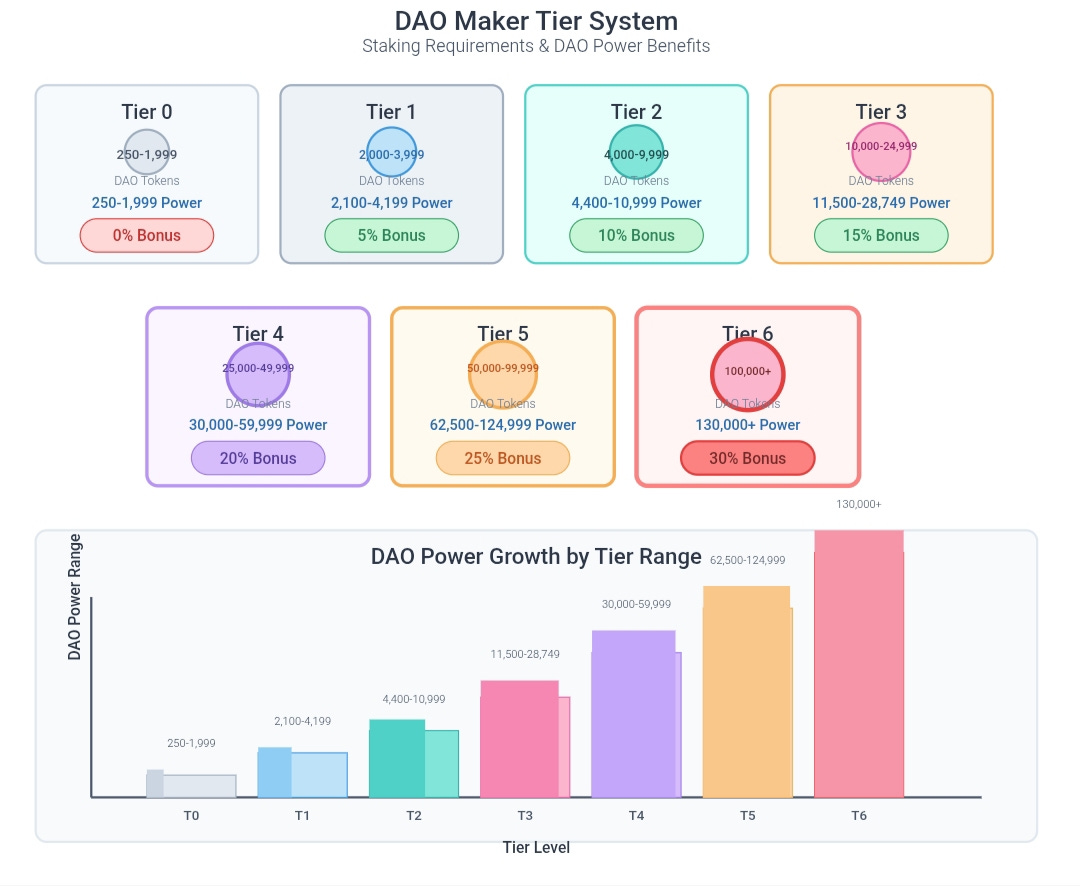

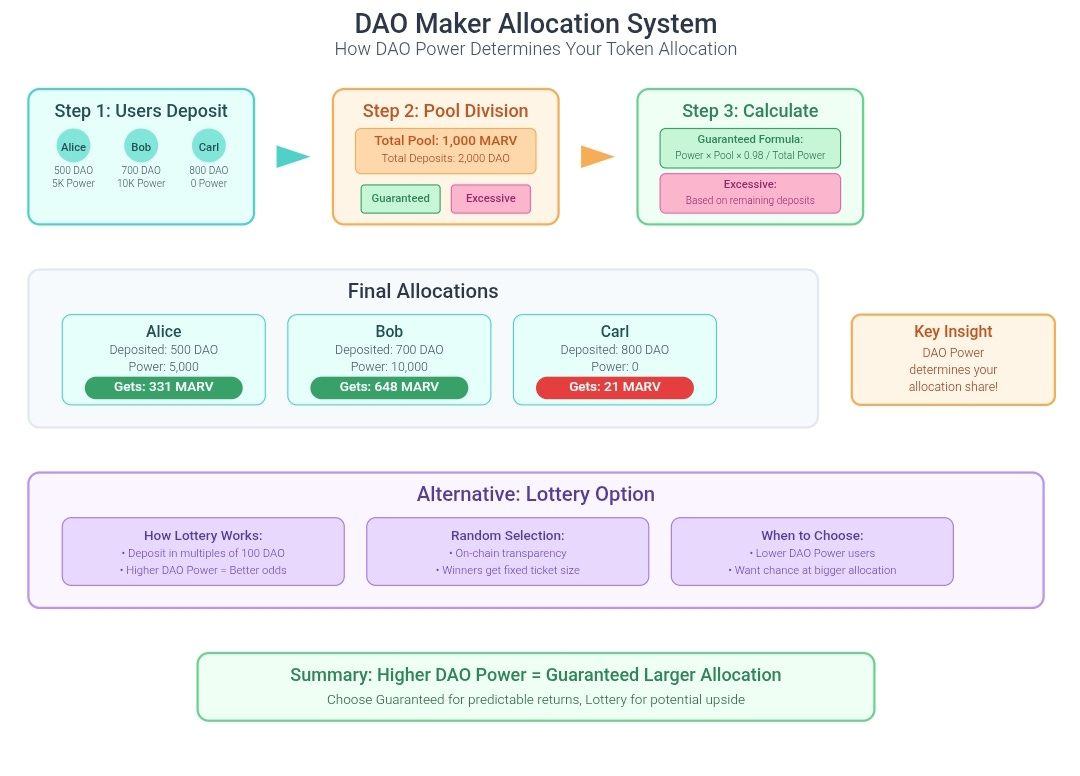

DAO Maker is well known for its token launch mechanism known as Strong Holder Offerings (SHOs), where DAO token stakers earn DAO Power based on their stake tier, which gives them purchasing power in any IDO held on the platform.

Whenever a token sale is available, users first opt into the sale by depositing their intended amount. After the opt-in period ends, the total amount and DAO Power allocated to the sale are calculated, and each individual is awarded IDO tokens based on their DAO Power and the amount allocated to the sale.

DAO Power is used for private sales systems, but for public sales, the platform uses USDT (1 USDT = 1 Share) to participate in fundraising.

However, they can use DAO ($1 worth of DAO = 5 Shares) to boost their IDO token amount. Public sales systems are not popular on DAO Maker.

Token Distribution Strategies

Token Vaults: This allows DAO token holders to stake tokens (DAO and/or the Vault Reward Token) for a set period in order to earn the Vault Reward Tokens.

Token Vesting: DAO Maker gives startups the option of vesting and distributing assets over time to their SHO participants.

Refundable Sales: Founders can also choose Refundable SHOs where 80% of DAO used to participate is held by DAO Maker and is refundable for a 6-month period.

Token and Token Holder Benefits

DAO Maker's platform token is DAO, and it grants holders various benefits on the platform.

Staking: DAO holders stake DAO in their staking vaults to earn DAO tokens, which are distributed daily. Also, staking DAO in partner token vaults earns users that vault's reward token.

DAO Power & DAO Boosts: Based on DAO staked, users earn DAO Power, which is used for private SHOs. Also, in public SHOs, users who participate with DAO tokens get a 500% allocation boost.

Governance: DAO token holders use the DAO to vote on platform and ecosystem changes, while SHO token holders have limited influence over how the raised funds are spent.

Social Mining: This process turns passive SHO token holders into active contributors by rewarding everything from marketing help (tweets) to development work (code), with rewards determined by community voting.

Legal and Technical Mechanisms

Legal and Security: DAO Maker uses a rigorous 4-stage vetting process that includes initial application screening, founder interviews, technical/legal due diligence requiring MVPs and smart contract audits, and cap table optimization.

Only high-quality projects pass their stringent criteria, with DAO Maker boasting that only 5% of their token sales went below listing price, demonstrating their effective project curation and quality control.

KYC: Users must complete KYC in order to be able to claim their SHO tokens after sales end.

UX: The platform requires no coding to either participate in or create an SHO, as it has excellent UX that makes everything intuitive.

Ease of Investment: Currently, users need a minimum of 2,000 DAO to participate in private SHOs, but public SHOs have lower USDT barriers.

DAO Maker Pros

For Founders

Rigorous Vetting Provides Credibility: DAO Maker's 4-stage selection process and only 5% of projects going below listing price establishes strong market confidence.

Comprehensive Support Beyond Funding: Its support system involves cap table optimization, marketing support, audits, and access to community-building tools.

Risk-Reduced Offerings: With Refundable SHOs, founders can create trust with investors, as they can get their money back in case of failure.

Instant Post-Launch Trading: Projects gain immediate DEX liquidity and exchange listings when they IDO on DAO Maker.

Quality Investor Base: Founders have access to 315K+ KYC'd users with proven track records and long-term commitment.

For Investors

Exceptional Track Record: Investors should expect strong investment performance and consistent ROI potential.

Risk-Mitigation Frameworks: Multiple downside protection mechanisms including refunds, principal protection, and vesting structures.

DAO Power Benefits: Staking DAO tokens provides guaranteed allocations, private SHO access, and 2-10x allocation multipliers through vault systems.

Community Rewards: Investors earn passive income through staking, farming rewards, and airdrops while participating in platform governance.

DAO Maker Cons

For Founders

Extremely Selective Process: Rigorous 4-stage vetting assessments can delay launches by 1-3 months.

Mandatory Cap Table Changes: DAO Maker often requires founders to restructure investor allocations, potentially causing friction with existing backers.

Privacy Concerns: Their KYC might hinder some investors in the founders' communities who prioritize privacy.

For Investors

High Barrier to Entry: Requires minimum 2,000 DAO tokens staked to participate in quality offerings, which creates a financial gatekeeping system.

Learning Curve Complexity: Understanding vesting schedules and DAO Power systems requires significant investor education.

Limited Project Selection: DAO Maker's selective vetting means fewer IDOs are available compared to permissionless platforms.

Governance Exclusion: Token holders cannot vote on project listings.

Builder Sustainability for Founders

Capital Formation: Proven fundraising efficiency with $107M+ total raised across projects and $2B+ total FDV.

Community Retention: DAO Maker's community formation technologies (social mining) create engaged, long-term supporter bases.

Ecosystem Support: DAO Maker provides necessary post-launch support through multi-chain compatibility, treasury management, and exchange listings.

Ideal Founders: DeFi, GameFi, or infrastructure teams with audited contracts, strong technical foundations, and willingness to accept guidance on tokenomics and marketing.

Builder Sustainability for Investors

Return Potential: Investors should expect consistent outperformance as most projects maintain prices above their listings with potential for 2-10x ROI.

Community Value: Staking rewards, farming opportunities, and airdrop eligibility provide multiple income streams beyond token appreciation.

Information Access: DAO Maker's comprehensive research pages, founder AMAs, and due diligence reports enable informed investment decisions.

Risk Management: With refunds, vesting schedules, and liquidity locks, DAO Maker reduces scam and rug pull risks.

Ideal Investors: Retail and institutional investors seeking curated early-stage exposure with risk mitigation, comfortable with $5K-$50K allocations and long-term holding strategies.

Believe: The Social Token Launchpad

The Believe App is a Solana-based platform that lets users create and launch tokens directly through X posts, fostering community-driven projects and social trading.

Noodle (gaming), Dupe (furniture search), and Gooncoin (memecoin) launched in May 2025 through Believe and reached $20M-$60M in market cap within days.

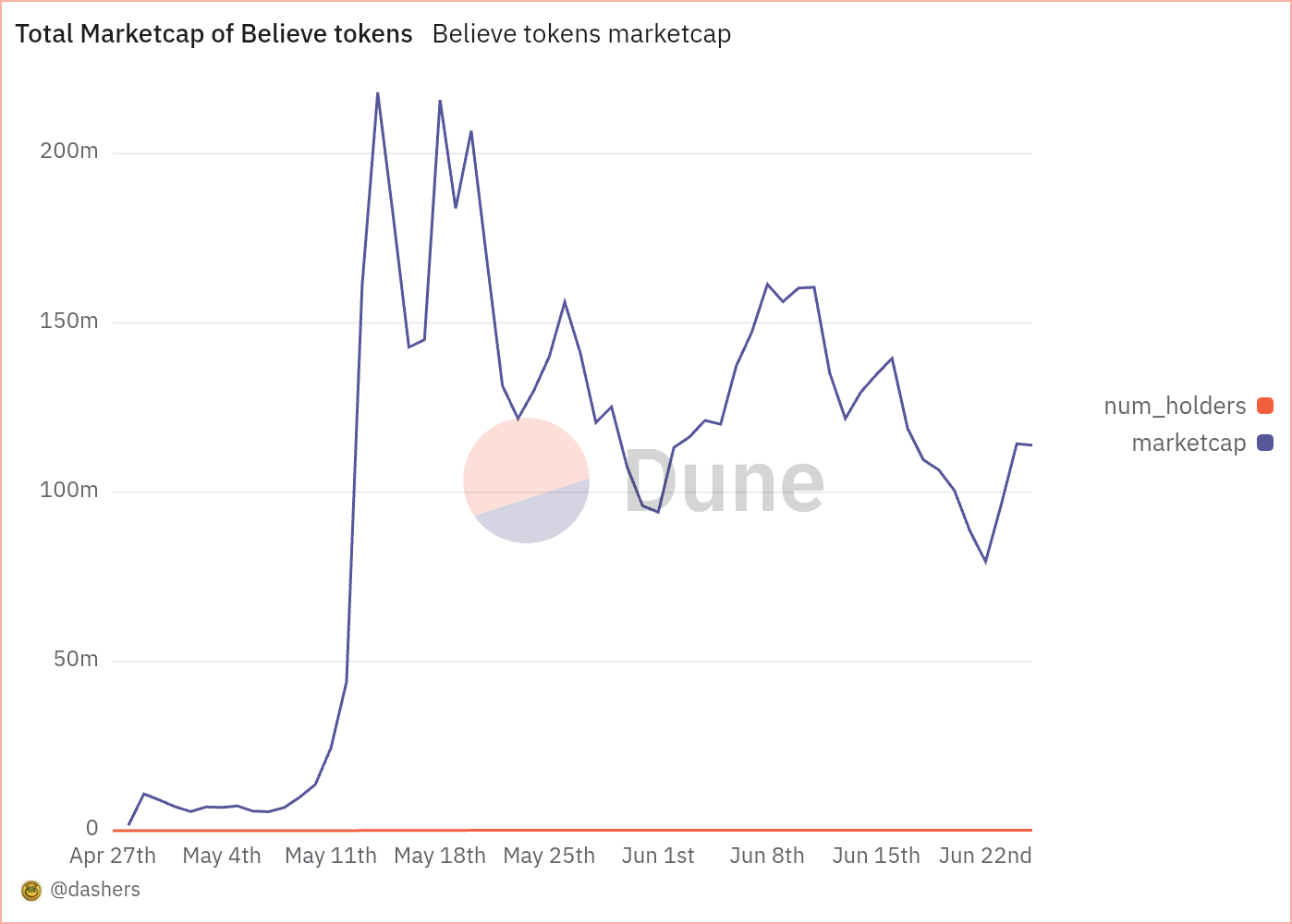

Platform Metrics

Launch Blockchain: Solana

Total Trading Volume: $3.79B+

Total Fees Collected: $75.9M+ (2% of trading volume)

Total Token Launches: 40,755

Total Graduated Tokens: 1427

Unique Participants: 479,750

Types of Projects: Memecoins, Gaming, Utility tokens, Real businesses

Average Graduation Threshold: $100K market cap

Investor ROI (ATH): 100-2,000x

Launch Mechanism

Believe allows users to create tokens by simply replying to X posts from "@launchcoin" with a ticker name—a process they describe as social token funding.

The platform uses bonding curves to establish fair trading during launch, and it automatically transfers successful tokens to Meteora DEX once they reach a $100,000 market cap. A bonding curve is an automated pricing mechanism where a token's price increase gradually as it is purchased and decrease as tokens it is sold. This process ensures fair price discovery and prevents whale manipulation.

Token Distribution Mechanisms

Believe offers streamlined tools to founders which includes:

Automated Deployment: The platform handles all the hassle of token deployment and initial liquidity provision, allowing Creators to launch tokens with Zero Technical Know-how.

Social Distribution: Believe’s integration with X allows creators to launch and grow their token via social media engagement.

Revenue Sharing: Creators earn 1% of all trading volume as ongoing royalties, providing sustainable income streams and enabling them to raise money for their ideas or projects.

Token and Token Holder Benefits

The Believe Platform token is LAUNCHCOIN and it grants benefits for the broader ecosystem participants.

Revenue Exposure: The token's value is tied to the platform's activity and success, with its holders benefiting from price increase as the ecosystem grows.

Fee Structure: Believe applies a 2% fee on each swap transaction (both on the Believe bonding curve and Meteora DEX), and splits the proceeds as follows:

1% to token creators

0.1% to community scouts

0.9% to platform operations.

Legal and Technical Mechanisms

Legal and Security: Believe is a permissionless platform; it doesn't conduct any founder scrutiny because anyone can use the platform to launch their token.

KYC: No KYC is required for users to participate as it operates as an open platform and is accessible through browsers and app stores.

Anti-Fraud Protection: On Believe, creators are not allowed to claim trading fee allocations in the first 24 hours of launch. They also have manual reporting systems for suspicious creator or trading activities.

Token Metadata Mutability: On Believe, creators can change token names, tickers, and URLs after the token launch. This functionality creates flexibility but can, however, be seen as a potential security risk.

UX: Creators and traders require no coding knowledge or crypto wallets; they need only an email and an X account to get started, making it accessible to Web2 users.

Ease of Investment: Anyone can participate in token launches; we estimate the minimum token purchase value to be around $5-$10.

Believe Pros

Founders

Believe's use of social media (X) enables creators to easily market and grow their community organically from day one.

Zero technical barriers—no coding, wallets, or blockchain knowledge required.

Immediate monetization through 1% revenue sharing on all trading activity.

Platform specifically designed for real businesses and utility projects beyond memecoins.

The mobile app approach attracts Web2 users and mainstream adoption.

Investors

The fair launch mechanism through bonding curves prevents whale dominance and sniping.

Early access to socially-validated projects with organic community engagement.

High potential returns—successful tokens achieved 100-2,000x ROI at peak.

No presales or insider advantages—truly democratic participation.

Social validation through X engagement provides market sentiment indicators.

Believe Cons

Founders

Limited Customization Options: With the standard way of deploying tokens, Believe is not suitable for projects with unique tokenomics.

Metadata mutability allows creators to change project details after token launch, which can potentially enable deceptive practices.

Revenue sharing requires an ongoing 1% fee on all trading activity; this might not be profitable for creators long-term, especially when trading volume declines.

Recent activity decline shows potential sustainability challenges as daily launches dropped from 5,000+ to under 1,000 (June 2025).

Believe tokens have limited utility beyond speculation—no governance, staking, or platform-specific benefits.

Investors

High speculation environment with most tokens being memecoins with limited utility fundamentals.

Rapid token dilution as the platform handled thousands of new launches daily at peak activity.

Metadata Mutability Risk: Token creators can alter project characteristics after gaining traction.

Volatility Concerns: The platform revenue dropped sharply from $14.17M weekly to $340K daily, indicating cooling interest (June 2025).

Builder Sustainability for Founders

Capital Formation: Believe generated $6.3 million in daily fees at peak, demonstrating rapid fundraising capabilities for viral projects.

Community Retention: Believe's close connection with X allows creators to connect with traders and holders, essentially creating a community around the token.

Ecosystem Support: Meteora graduation provides professional market-making for successful projects, ensuring long-term liquidity and trading infrastructure.

Ideal Founders: Social media-native entrepreneurs, influencers with engaged audiences, game developers, real-world business builders, and community-driven project creators.

Builder Sustainability for Investors

Return Potential: With notable tokens reaching $20-60 million market caps within days, investors should expect a 100-1000x return on a well researched project.

Social Discovery: X token launch discovery allows good projects to go viral organically through social media engagement and community validation.

Risk Management: With the bonding curve model, Believe ensures price stability and prevents whale manipulation during early phases.

Ecosystem Diversification: Different types of projects can be launched on Believe from memecoins to utility tokens and real businesses.

Ideal Investors: Social media-savvy retail investors comfortable with viral trends, memecoin enthusiasts seeking early-stage exposure, crypto-native users familiar with high-risk scenarios ($100-$10K), and community-driven participants who value social engagement over pure financial returns.

MetaDAO: Decision Market Launchpad

MetaDAO is a Decision Market Governance platform on Solana that recently launched its Launchpad, which is used to create Decision Market DAOs for management of funds raised through IDOs.

mtnDAO raised $5,758,964 via an IDO on MetaDAO April 2025.

What are Decision Markets or Futarchy? Simply put, it's a type of DAO governance system that places an ecosystem proposal against the value of the DAO's token.

In futarchy platforms like MetaDAO, the market of the token is simulated using an Automatic Market Maker (AMM) specially made for that proposal.

Users trade the AMM for a period, and the price of the AMM is compared to the actual price of the token.

If the "no" side of the market pushes the simulated AMM price below the actual price, the proposal fails.

If the "yes" side of the market pushes the simulated AMM price above the actual price, the proposal passes.

The futarchy concept ensures that the token or asset price should control decision-making because bad decisions affect token or asset holders.

Platform Metrics

Launch Blockchain: Solana

Total Raised: $5.76M

Total Fees Collected: $0

Total Fundraisers: 1

Types of Projects: Any type of project

Average Funds Raised: $5.76M

Unique Participants: 1931

Investor ROI (ATH): 2.5x

Launch Mechanism

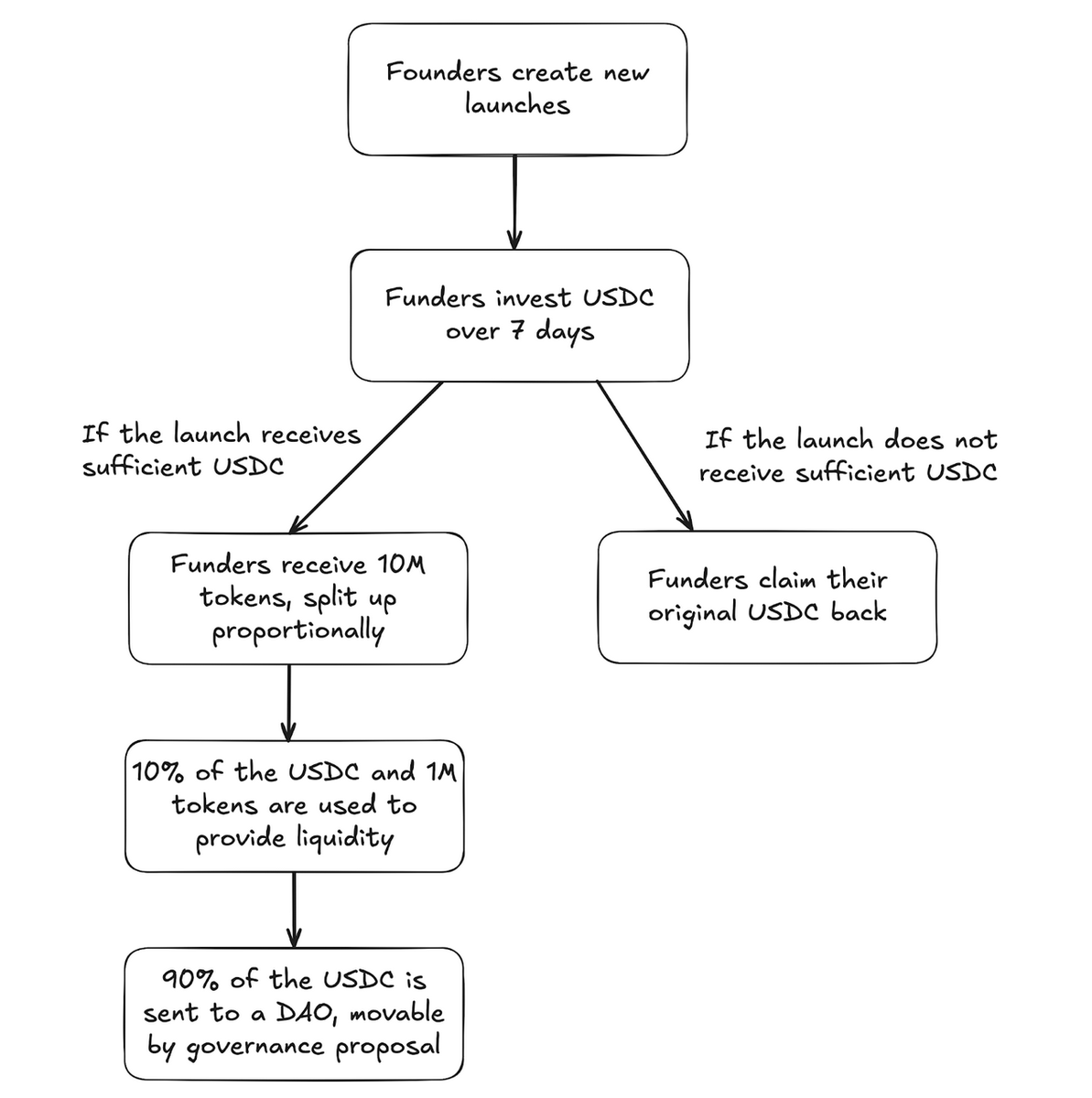

MetaDAO uses a Futarchy-based Launchpad system, where founders or teams initiate an IDO on their platform, selecting the minimum and maximum amounts they intend to raise for a fixed period (7 days) while users contribute to the IDO.

At the end, if the minimum is not reached, users can collect their money back, but if the minimum is reached or surpassed, users get to share 10 million tokens that are distributed proportionally to what they contributed.

After that, 1 million tokens and 10% of the funds raised are used to launch token trading on a DEX.

Users can either cash out via DEX or use their tokens to govern 90% of the funds raised via a Decision Market DAO.

Token Distribution Mechanisms

Refundable Sales: If the minimum required funds are not reached, all IDO funds are returned.

Futarchy Controlled Token Contract: Future token emissions, whether for team, grants, rewards, etc., are governed by the Decision Market DAO.

No Token Vesting: Since founders have no initial allocation, they don't have to worry about the token price, as if some holders sell the tokens, others will buy them to gain more share in the DAO governance.

Token and Holder Benefits

MetaDAO's platform token is META, and it is used to govern the platform and create DAO proposals for its own DAO and other DAOs using their governance platform, which would include resulting DAOs from their Launchpad.

IDO Token Governance: Tokens created from the Launchpad give holders governing rights over how the funds are used, future token emissions, and how the resulting project or initiative is managed.

Legal & Technical Mechanisms

Legal and Security: MetaDAO core contributors carry out due diligence on the founders and vet their platform or protocol to ensure that they are investment-worthy.

If the IDO is successful, a DAO LLC is created in the Marshall Islands for the token holders; this was done for mtnCapital in their last raise.

KYC: KYC is not required for users to participate; it's a fully on-chain process that prioritizes equitable token distribution and privacy.

UX: The platform requires no coding to participate in an IDO, as it has excellent UX that makes everything intuitive.

Ease of Investment: Currently, there's no official minimum for users to participate in MetaDAO IDOs; users need only USDC and SOL for gas in their wallets to participate.

MetaDAO Pros

For Founders

Innovative Governance Model: Futarchy-based decision markets ensure rational decision-making based on token price performance, reducing emotional or biased governance decisions.

No Founder Token Allocation: Eliminates concerns about founder dumping or price manipulation since founders receive no initial tokens, creating aligned incentives with investors.

Legal Protection: DAO LLC formation in Marshall Islands provides legal structure and protection for token holders and founders.

Cost-Effective Launch: Zero platform fees make it attractive for early-stage projects with limited budgets.

Instant Liquidity & Governance: 10% of funds automatically create DEX liquidity while 90% remains under community governance through decision markets.

Privacy-First Approach: No KYC requirements protect founder and investor privacy while maintaining regulatory compliance through offshore structures.

For Investors

True Decentralized Governance: Investors gain real control over 90% of raised funds through futarchy-based decision markets rather than empty governance tokens.

Refund Protection: Full refund guarantee if minimum funding isn't reached provides downside protection.

Fair Token Distribution: Fixed 10 million token supply distributed proportionally ensures equitable allocation without insider advantages.

No Vesting Manipulation: Absence of founder allocations and vesting schedules eliminates dilution risks and price suppression.

Rational Decision Making: Futarchy system aligns governance decisions with token price performance, protecting investor interests.

Low Barrier to Entry: No minimum investment requirements make it accessible to retail investors.

MetaDAO Cons

For Founders

Limited Track Record: With only one IDO completed, the platform lacks proven long-term success metrics for founders to evaluate.

Complex Governance Model: Futarchy system may be difficult for some founders to understand and explain to their communities.

No Initial Founder Rewards: Founders receive no immediate token allocation, requiring alternative compensation structures or long-term commitment to governance participation.

Regulatory Uncertainty: While offshore DAO LLC provides some protection, futarchy governance mechanisms face unclear regulatory treatment.

For Investors

Governance Complexity: Understanding and participating in futarchy decision markets requires significant learning curve for average investors.

Limited Project Diversity: Currently only proven with one project type, limiting investment options compared to established platforms.

Untested Long-term Viability: Decision market governance hasn't been stress-tested through market downturns or major governance crises.

Platform Concentration Risk: Single successful IDO means platform sustainability depends heavily on continued successful launches.

Builder Sustainability

For Founders

Capital Formation: Early-stage platform with $5.76M raised demonstrates proof of concept but needs more successful launches to prove scalability.

Community Retention: Futarchy governance creates engaged, economically-aligned communities focused on project success rather than short-term speculation.

Ecosystem Support: Direct integration with Solana DeFi ecosystem and automatic DEX listings provide necessary infrastructure, though post-launch support systems are still developing.

Ideal Founders: Innovative DeFi or governance projects comfortable with experimental models, strong technical teams able to explain complex mechanisms to communities, and founders willing to build long-term value without immediate token rewards.

For Investors

Return Potential: Limited track record with 2.5x ATH ROI shows modest but positive early performance, though sample size is too small for reliable projections.

Community Value: Governance participation provides ongoing engagement and influence over project direction, creating value beyond token appreciation.

Information Access: Transparent on-chain governance and decision markets provide clear visibility into project performance and community sentiment.

Risk Management: Refund mechanisms and futarchy-based decisions reduce some risks, but platform novelty introduces new categories of experimental risk.

Ideal Investors: Early adopters comfortable with experimental governance models, investors seeking active governance participation rather than passive holdings, and those comfortable with $500-$50K allocations who understand DeFi mechanisms and can participate meaningfully in decision markets.

Crypto Startup and Capital: Highlighting the Types of Founders Seeking Investments

In this Section we compare the four Launchpads, and we discuss various types of founders seeking capital and give an unbiased answer to their search of a potential Launchpad.

Institutional Credibility Seeker

Question: We need investors to take us seriously and want a platform with a proven track record.

Answer: DAO Maker because their 4-stage vetting process and 95% success rate will give you instant credibility with institutional investors.

Fair Launch Advocate

Question: We are tired of whales and bots ruining token launches. We want something truly fair.

Answer: Fjord Foundry because their Dutch auction starts high and drops until fair price is found, bots can't snipe and whales can't manipulate.

Budget-Conscious Founder

Question: We're bootstrapped and can't afford high platform fees or minimum requirements.

Answer: Believe because token creation is very cheap, you only pay 1% of trading volume as you earn revenue, making it perfect for bootstrap startups.

Multi-Chain Builder

Question: Our protocol will deploy on Ethereum, Solana, Polygon, and BSC. We need broad ecosystem support.

Answer: Fjord Foundry because they support multi-chain launches and have the largest cross-ecosystem investor base.

Retail-Focused Project

Question: We're building a consumer app and need access to everyday crypto users, not just DeFi degens.

Answer: Believe and DAO Maker are both excellent for retail access. Believe's X integration and mobile-first approach attracts Web2 users who don't even need crypto wallets to participate. While DAO Maker offers 315,000+ KYC'd retail investors who've proven they'll buy and hold quality projects, providing access to verified everyday crypto users rather than just DeFi speculators.

Governance Innovator

Question: We're experimenting with new DAO governance models and want a platform that gets it.

Answer: MetaDAO because they invented the first futarchy for crypto, they'll understand your governance innovations better than anyone.

Results-Driven Team

Question: We need guaranteed success. Show me the numbers.

Answer: DAO Maker, as 95% of their projects stay above listing price. Only 5% have ever gone below initial price.

DeFi Infrastructure Builder

Question: We're launching a new AMM and need immediate liquidity without price manipulation.

Answer: Fjord Foundry, because LBPs are perfect for DeFi, you'll get fair price discovery and instant DEX integration.

Solana Native

Question: We're all-in on Solana and want a platform that truly understands the ecosystem.

Answer: Both Believe and MetaDAO are excellent choices - Believe for social-first token launches with X integration and Meteora graduation. While MetaDAO is for experimental governance with futarchy decision markets. Both are Solana-native with deep ecosystem understanding.

Privacy Advocate

Question: KYC requirements will scare away our privacy-focused community.

Answer: Believe and MetaDAO because they're completely permissionless with no KYC required.

Social Media Influencer

Question: We have a massive social media following and want to leverage that for our token launch.

Answer: Believe because their X-native launch mechanism turns your social media engagement into instant token creation and viral marketing.

Experimental Builder

Question: We're pushing the boundaries of what's possible in crypto governance.

Answer: MetaDAO, they're pioneering futarchy decision markets. The most cutting-edge governance mechanism in crypto.

Long-term Value Creator

Question: We want to eliminate any founder selling pressure and prove we're in this for the long haul.

Answer: MetaDAO, they give zero founder allocation means no dumping risk, you'll earn tokens through governance just like everyone else.

Viral Project Creator

Question: We want our token launch to go viral and reach mainstream audiences.

Answer: Believe because their social token funding through X creates built-in viral distribution, with tokens like GOONCOIN reaching $60M market cap within days.

Technical Beginner

Question: We have a great idea but zero coding experience or crypto knowledge.

Answer: Believe because you can launch tokens with just a tweet—no wallets, coding, or technical knowledge required, making it perfect for Web2 entrepreneurs.

Case Study of PUMP Token: Creating Value and Governing an Attention Market Ecosystem with Futarchy

Pump.fun a renowned memecoin Launchpad and DEX on Solana is yet to launch their community and governance token.

Launchpad & Token Strategy

PUMP token targeting pump.fun's meme coin community would leverage MetaDAO's futarchy governance to create a "PUMP DAO" that makes collective decisions about which meme coins to promote, fund, or acquire, and certain community and platform governance.

The Launch Process

We recommend that the team raises $10M-$50M through MetaDAO's Launchpad.

The DAO’s Purpose

We recommend that PUMP DAO should function majorly as a memecoin investment fund.

The DAO will use holders' vote for token acquisitions, marketing campaigns, and pump.fun project incubations.

If the Decision Market believes promoting a particular memecoin will increase PUMP token price, then that proposal passes.

Benefits

MetaDAO's zero founder allocation perfectly aligns with meme coin culture's fair token launch ethos.

MetaDAO’s Solana-native infrastructure connects directly with pump.fun's ecosystem.

This process enables Degens to make careful bets on which meme projects have real potential instead of mindlessly pumping tokens.

Degens already understand price speculation and token markets, they can easily understand futarchy's "trading as vote" concept.

MetaDAO’s DAO LLC structure protects this token community from potential regulatory issues

The MetaDAO's No KYC policy allows all types of Degens to participate in the fundraiser.

Recommendations

Pump.fun founders should launch PUMP token with viral meme-focused marketing emphasizing "finally, a way to make your degen plays actually productive"

They should also partner with successful pump.fun projects for cross-promotion and initial legitimacy.

The Future of Fundraising: How MetaDAO secures both Investor and Founder interests

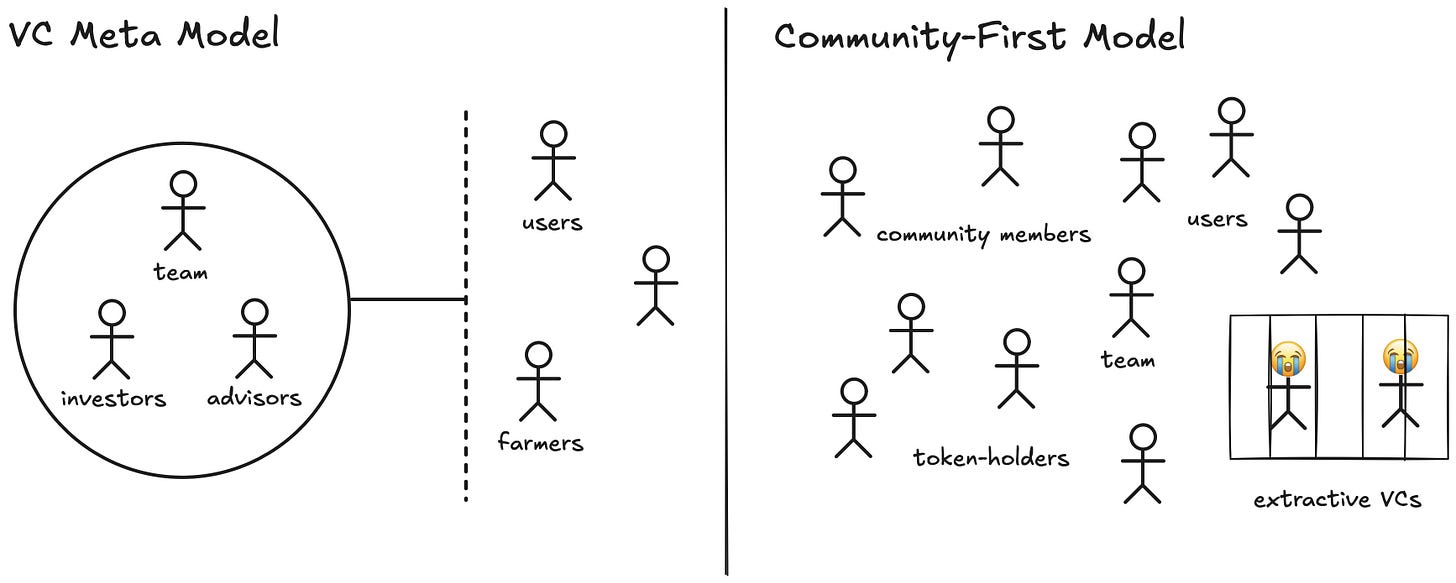

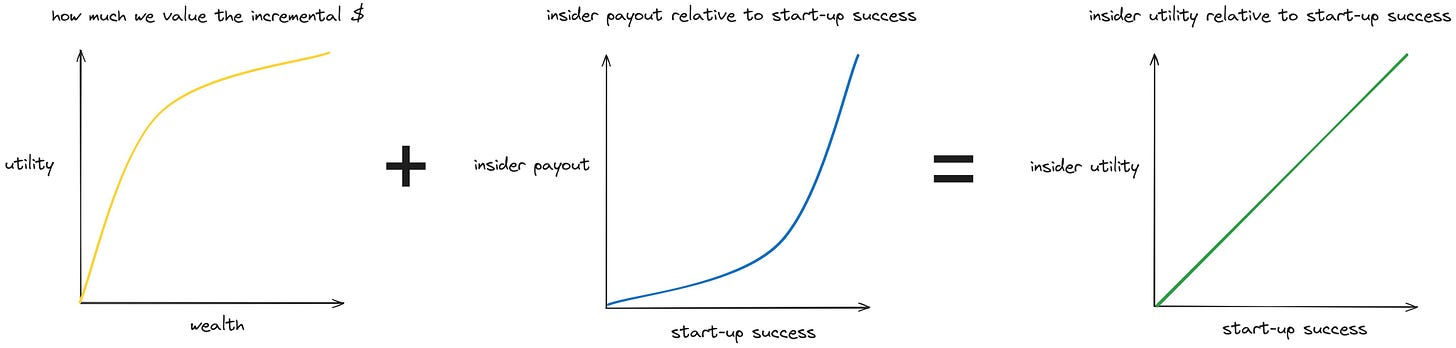

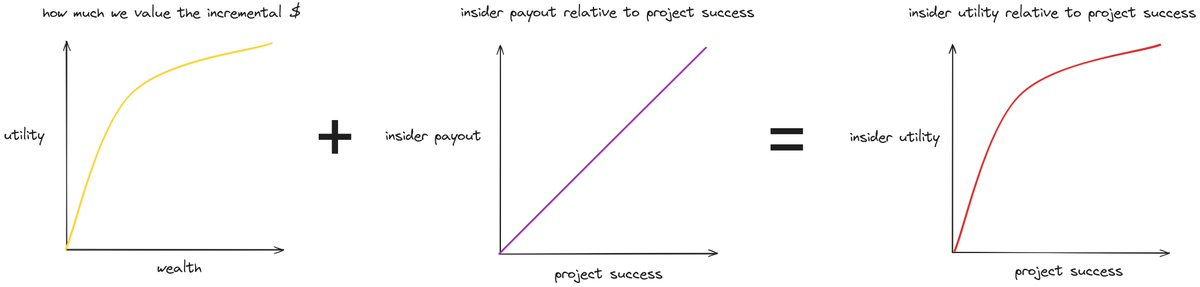

Fundraising in crypto today uses vesting schedules and pre-allocations to isolate core investors (token holders) from the decision-making of the platform, which causes huge downsides for them, resulting in token price decline.

MetaDAO believes that this situation is prominent because token holders are not involved in the core decision-making of these platforms and projects.

Let's imagine Silicon Valley startup founders who raise money to scale their startup. They have three options:

Scale the startup to IPO, become billionaires

Scale the startup to acquisition, become multi-millionaires

Don't scale, go bankrupt and return to square one

You realize that they are more eager to improve until improvement becomes part of their lives. Projects that IPO go further to $100B+ margins; those involved in acquisitions move ahead to create better startups.

This is a big contrast to crypto startups, with an option:

To raise money from VCs

Launch tokens via IEO and IDO that are not tied to how they manage the platform

Create wealth via pre-allocations

This not only introduces criminal behavior and VC dumping, but it also deters their potential to grow higher when their token reaches the $1B market cap margin, limiting new user acquisition and investor introduction.

This happens because they already made wealth from pre-allocations and also because they are not under close watch by token holders.

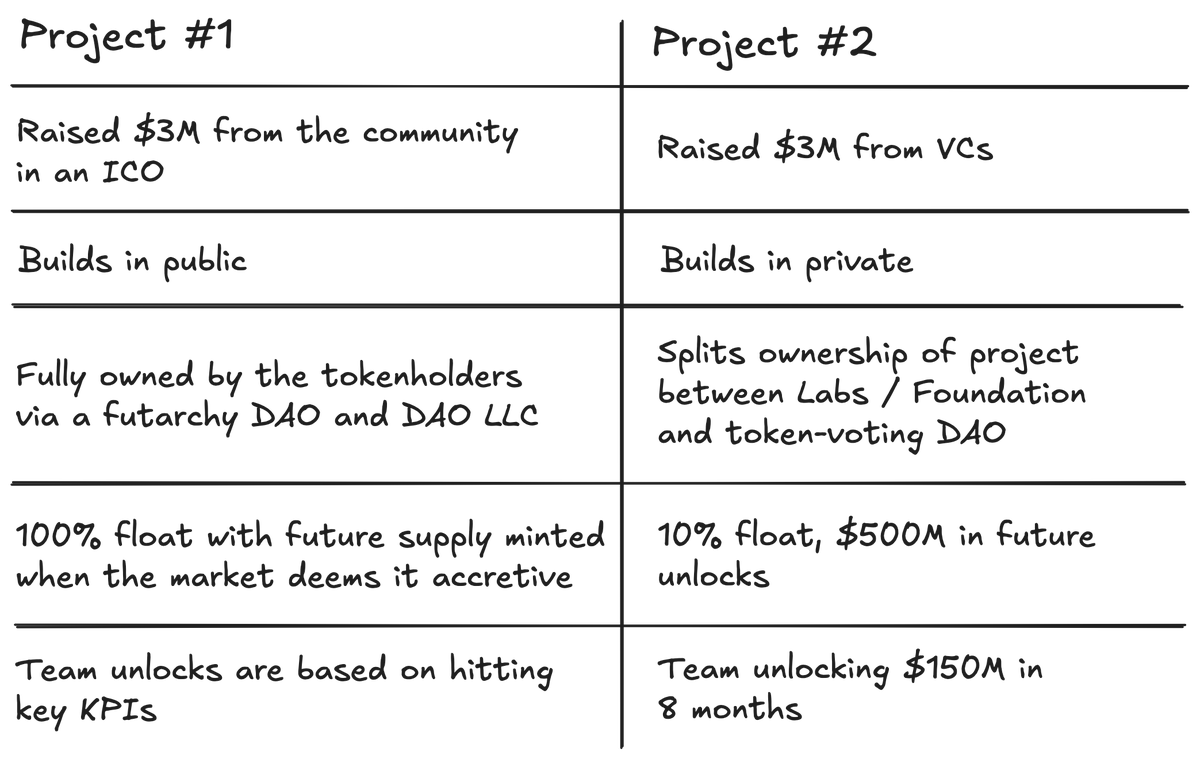

With Futarchy DAOs, raised funds and token emissions are controlled by the DAO.

The DAO can vote to issue founder allocations incrementally as tokens achieve and maintain new prices.

Founders can't rug the token or project, and in the case that they fold, DAO members can vote to redeem their money back through the DAO token.

MetaDAO is using Futarchy and its Launchpad to create startups where token holders are prioritized as shareholders in decision-making and fund management.

This is how crypto startups will be able to scale beyond the current stance to global adoption level, and it happens when they treat token holders like shareholders.

Conclusion

MetaDAO's futarchy-based launchpad represents the future of crypto fundraising by aligning founder incentives with token holder success through market-driven governance and zero pre-allocations.

This model ensures that crypto startups can scale to global adoption levels by treating token holders as true shareholders rather than exit liquidity for founders and VCs.

Fjord and DAO Maker, however unique they are with their KYC, token launch mechanisms, vesting, and due diligence models, still launch projects that lack governance accessible to token holders. This effectively leads to project rugging, price decline, VC dumping, founder disincentivization, and token holder neglect in the long-term.

They are perfect examples of how most Launchpads today behave. Not that they are bad, just that they don't provide investor security and long-term assurance, as they only do token vesting for short periods (founders 3-4 years & affiliates 1-3 years). This vesting system leaves control of the token to these founding entities after tokens unlock, which in turn causes the situations discussed earlier.

Believe takes a different approach with its permissionless, user-friendly platform that shares fees with creators as a fundraising mechanism. However, it faces its own critical limitations: tokens launched through the platform often lack utility beyond speculation, making it easy for founders to abandon projects when token values decline. Additionally, the platform provides no accountability mechanisms to ensure proper use of raised funds, leaving investors vulnerable to mismanagement or fraud.

These negative situations can be avoided for token holders on Solana with futarchy DAOs, decision markets, and the MetaDAO Launchpad.

References

Amaral, T. (2025, May 17). Believe App’s Viral Hype Drives a 27,000% Rally for LAUNCHCOIN. Bitget; Bitget Exchange. https://www.bitget.com/news/detail/12560604762963

Believe App. (2025). Believe Playbook. Believe.app. https://believe.app/playbook

Binance Academy. (2022, January 24). What Is an IDO (Initial DEX Offering)? Binance Academy. https://academy.binance.com/en/articles/what-is-an-ido-initial-dex-offering

Binance Academy. (2025, February 8). What Is a Bonding Curve in Crypto? Binance Academy. https://academy.binance.com/en/articles/what-is-a-bonding-curve-in-crypto

Buterin, V. (2014, August 21). An Introduction to Futarchy. Ethereum Foundation Blog. https://blog.ethereum.org/2014/08/21/introduction-futarchy

Coingecko. (2025a). DUPE Token Info. CoinGecko. https://www.coingecko.com/en/coins/dupe

Coingecko. (2025b). GOONC Token Info. CoinGecko. https://www.coingecko.com/en/coins/gooncoin

Coingecko. (2025c). NOODLE Token Info . CoinGecko. https://www.coingecko.com/en/coins/noodle

CryptoRank. (2019). DAO Maker Investment Dashboard. CryptoRank. https://cryptorank.io/fundraising-platforms/dao-maker

CryptoRank. (2021). Fjord Foundry Investment Dashboard. CryptoRank. https://cryptorank.io/fundraising-platforms/fjord-foundry

CryptoRank. (2024). YOUR AI. CryptoRank. https://cryptorank.io/ico/your

CryptoRank. (2025a). LAUNCHCOIN (on Believe). CryptoRank. https://cryptorank.io/price/ben-pasternak

CryptoRank. (2025). Stabble. CryptoRank. https://cryptorank.io/ico/stabble

DAO Maker. (2019). DAO Maker Whitepaper. Google Docs. https://drive.google.com/file/d/1tPRMktnros6ifJLfvQkrT6mAmEJvUufT/view

DAO Maker. (2023). DAO Token Analytics. Daoanalytics.io. https://www.daoanalytics.io/rewards

DAO Maker. (2025, February 28). DAO Maker Docs. Gitbook.io. https://dao-maker-1.gitbook.io/dao-maker

dashers. (2025). Believe In Something - Launchacoin Numbers. Dune.com. https://dune.com/dashers/believe-in-something-launchacoin-numbers

Decentralized Dog. (2022). What Is an IEO? CoinMarketCap Academy. https://coinmarketcap.com/academy/article/what-is-an-ieo

Deer, M. (2023, February 19). What is a crypto launchpad, and how does it work? Cointelegraph. https://cointelegraph.com/news/what-is-a-crypto-launchpad-and-how-does-it-work

DeFillama. (2021). DAO Maker Vesting Dashboard on DefiLlama. DefiLlama. https://defillama.com/protocol/dao-maker-vesting?denomination=USD

DeFillama. (2024). Fjord Foundry DefiLlama Dashboard. DefiLlama. https://defillama.com/protocol/fjord-foundry

DeFillama. (2025). DAO Maker Raise Dashboard on DefiLlama. DefiLlama. https://defillama.com/raises/dao-maker

Fjord Foundry. (2024). Fjord Foundry Blogs. Medium. https://medium.com/@fjordfoundry

Fjord Foundry. (2025a). Fjord Stats. Fjordfoundry.com. https://www.fjordfoundry.com/fjord-stats

Fjord Foundry. (2025b, April 8). Fjord Foundry Docs. Fjordfoundry.com. https://help.fjordfoundry.com/fjord-foundry-docs/

Frankenfield, J. (2022, August 18). Initial Coin Offering (ICO). Investopedia. https://www.investopedia.com/terms/i/initial-coin-offering-ico.asp

gm365. (2025). Believe Dashboard. Dune.com. https://dune.com/gm365/believe

gooddata_badguy. (2025). Fjord Foundry Dune Dashboard. Dune.com. https://dune.com/gooddata_badguy/fjord-foundry-overview

Hayes, A. (2024, October 18). What Is Venture Capital? Definition, Pros, Cons, and How It Works. Investopedia. https://www.investopedia.com/terms/v/venturecapital.asp

Heavey, K. (2024, October 28). Futarchy as Trustless Joint Ownership. Umbraresearch.xyz. https://www.umbraresearch.xyz/writings/futarchy

Jabeen, Z. (2025, February 10). Futarchy: The Future of DAO Governance. Medium; Harkness DAO. https://medium.com/@hrknsinst/futarchy-the-future-of-dao-governance-9dd00a18a423

Loke Choon Khei. (2025, May 15). What Is Believe? Launching Memecoins via X Replies. CoinGecko. https://www.coingecko.com/learn/what-is-believe-token-launchpad

MetaDAO. (2024, May 20). MetaDAO Docs. Metadao.fi. https://docs.metadao.fi/

MetaDAO. (2025a). mtnCapital Governance Dashboard. MetaDAO. https://metadao.fi/mtncapital

MetaDAO. (2025b). mtnCapital IDO Dashboard. Metadao.fi. https://metadao.fi/launchpad/projects/a3wqnp5LSi84ShMFwfPgULA3rVaNcL67UwTyccbMDNo

Metaproh3t. (2024, May 27). Fixing crypto’s incentives, for fun and for profit. X (Formerly Twitter). https://x.com/metaproph3t/status/1795082443210555496/

Metaproh3t. (2025a, February 6). If You’re Building a Project Today, You Should Do This. X (Formerly Twitter). https://x.com/metaproph3t/status/1887549194937753630/

Metaproh3t. (2025b, March 12). MetaDAO’s New Launchpad. X (Formerly Twitter). https://x.com/metaproph3t/status/1899823082900259017/

Metaproh3t . (2025, June 5). Ouch: MetaDAO Key Metrics. X (Formerly Twitter). https://x.com/metaproph3t/status/1930686351680409637/

mtnCapital. (2025). Operating Agreement for mtnDAO LLC. mtncapital.xyz. https://www.mtncapital.xyz/oa.pdf

mtnDAO . (2025, April 1). $MTN -- The New DAO. X (Formerly Twitter). https://x.com/mtndao/status/1907140496709075404/

obchakevich. (2025). DAO Maker Analysis ($DAO). Dune.com. https://dune.com/obchakevich/dao-maker-token

I enjoyed reading this. Futarchy can be a bit confusing but I'll go through it again in my spare time.

This was such a detailed breakdown and comparison of the launchpads.

I think the major upper-hand metaDAO has is in its refund protection and governance model.